arizona solar tax credit form

Income Tax Instruction Packet. No preapproval is required for an individual income tax credit for a residential Solar Energy Device tax credit that is claimed on Form 310.

Tax Credit Info Daylighting Systems Solar Powered Fans Solatube

See Ratings Compare.

. Arizona Form 2021 Credit for Solar Energy Devices 310 Include with your return. Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar. Form Code Form Name.

To claim this credit you must also. Arizona tax credit forms and instructions for all recent years can be obtained at. This is a one time tax credit and.

Enter Your Zip Find Out How Much You Might Save. Worth 26 of the gross system cost through 2020. Ad Find The Best Solar Providers In Arizona.

Some users have reported that even though they do not choose the solar energy credit for Arizona in the state review they are asked to fill some fields for form 310 Solar. To take advantage of these tax exemptions a solar energy retailer must register with the Arizona Department of Revenue prior to selling or installing solar energy devices. Enter your energy efficiency property costs.

IMPORTANT which you computed your credits with your individual income tax return. For the calendar year 2019 or. 101 1 You must include Form 301 and the corresponding credit forms for.

Arizona solar tax credit. 12 rows Renewable Energy Production Tax Credit. Ad Find The Best Solar Providers In Arizona.

The tax credit amount was 30 percent up to January 1 2020. The Arizona Solar Tax Credit lets you deduct up to 1000 from your personal Arizona income taxes. Arizona is a leading state in the national solar power and renewable energy initiative.

The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. The tax credit is equal to 10 of the installed cost of the solar energy device not to exceed 25000 in credits for one building in a single tax year and 50000 total. Arizona Department of Revenue tax credit.

Which Arizona tax form is used for solar energy tax credits. Arizona Residential Solar Energy Tax Credit. Enter Your Zip Find Out How Much You Might Save.

Arizona Form 319 Arizona Form 319 Credit for Solar Hot Water Heater Plumbing Stub Outs and Electric Vehicle Recharge Outlets 2019 Include with your return. This is claimed on Arizona Form 310 Credit for Solar Energy Devices. It is valid the year of installation only.

Resident Personal Income Tax Return Tax Return. Summary of solar rebates in Arizona. Favorable laws rebates property and sales tax.

Arizona Department of Revenue. Ad Find Arizona Solar Tax Credit. An Arizona income tax credit is offered to businesses that install one or more solar energy.

Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. Credit For Solar Energy Credit. Resident Personal Income Tax Short.

Arizona Renewable and Solar Energy Incentives. In case of inconsistency or omission the Arizona Revised Statutes ARS and or the Arizona Administrative Code will prevail over the language in this publication. The amount represents 25 percent.

See Ratings Compare. The Renewable Energy Production Tax Credit is applied for using Arizona Form 343. An income tax credit for the installation of solar energy devices in Arizona business facilities.

The renewable technologies eligible are Photovoltaics Solar Water Heating other Solar Electric Technologies. For the calendar year 2021 or fiscal year beginning M M D. Buy new solar panels in Arizona and get a 25 credit of its total cost against your personal income taxes owed in that year.

Every resident in Arizona who installs solar panels gets a State Tax Credit of 25 of the total system cost up to 1000 to be used toward State income taxes. Homeowners can claim a 25 tax credit on up to 4000 of solar devices installed on a residence effectively a maximum credit of 1000.

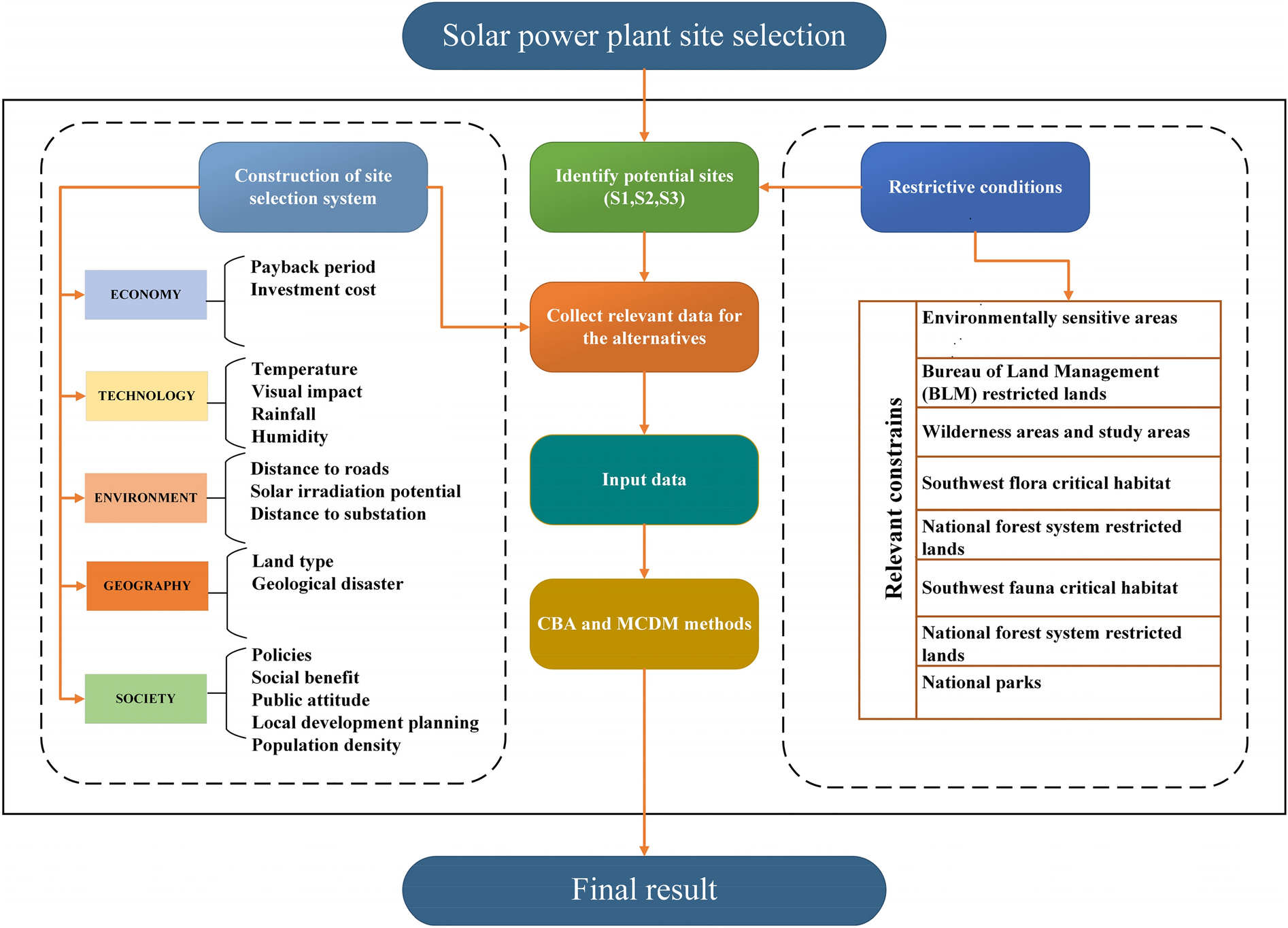

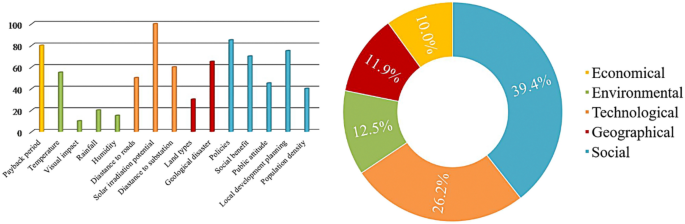

Application Of Choosing By Advantages To Determine The Optimal Site For Solar Power Plants Scientific Reports

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Biden Seeks 10 Year Extension Of Solar Tax Credit New Clean Energy Standard Reuters Events Renewables

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Instructions For Filling Out Irs Form 5695 Everlight Solar

What Is Solar Energy How Do Solar Panels Work Sunpower

Application Of Choosing By Advantages To Determine The Optimal Site For Solar Power Plants Scientific Reports

Solar Tax Exemptions Sales Tax And Property Tax 2022

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

I Am Not Claiming Solar Energy Device Credit How D

How To Claim The Solar Tax Credit Itc Irs Form 5695 Forme Solar

Solar Tax Credit In 2021 Southface Solar Electric Az

Solar Tax Credit Details H R Block